AI Investment Wave Hits the Global South: Innovation’s New Frontier

Here’s the thing, investors now see bigger returns outside old tech hubs, and the AI Investment Wave Hits the Global South: Innovation’s New Frontier explains why. Data volumes grow, local markets scale, and policy moves open doors. Global capital chases cheaper talent, faster adoption, and large underserved populations. This trend reshapes where products are built.

Introduction

The AI Investment Wave Hits the Global South: Innovation’s New Frontier because capital chases growth where infrastructure finally matches demand. Here’s the thing, markets in India, Southeast Asia, and the Middle East offer scale, local data, and regulatory openings, and that mix attracts global funds. Investors now prioritize AI investment shift, Global South innovation, and emerging-market AI over the same old bets. What this really means is new products aimed at local problems will gain rapid traction. Expect diverse models, fledgling research hubs, and more regional IP. The report saying nine in ten investors plan to move focus supports this shift, and that matters.

(Citation for the 9-in-10 finding: FII report and coverage). Consultancy ME+1

Table of Contents

- Why the Global South Is Suddenly on Every Investor’s Radar

1.1 From Silicon Valley to South Asia, The Great Investment Rebalance

1.2 The Rise of Local Talent and Startups - The Real Drivers Behind the AI Investment Shift

2.1 Affordable Data Infrastructure and Policy Pushes

2.2 Investors Chasing Untapped Markets and Better ROI - How the Global South Is Building Its Own AI Identity

3.1 Language, Local Problems, and Smarter AI Models

3.2 Collaboration Over Copying, A Different Innovation Mindset - Case Studies, India, Southeast Asia, and the Middle East

4.1 India’s Data Advantage

4.2 Southeast Asia’s Agile Ecosystem

4.3 The Middle East’s Bet on AI Sovereignty - The Next Frontier, Pakistan and South Asia’s AI Moment

5.1 Why Pakistan Could Ride the Wave

5.2 What’s Missing, Investment Confidence and R and D Depth - What This Shift Means for Global Innovation

6.1 The End of a One Size Fits All AI Economy

6.2 The Risk and Reward Equation for Investors - The Future, A More Balanced Tech World

7.1 A Global Network, Not a Global Hierarchy

FAQs, Case Study Table, CTA

1. Why the Global South Is Suddenly on Every Investor’s Radar

Here’s the thing, capital moves where data and customers meet. Rapid mobile adoption and cheaper cloud compute make emerging-market AI more profitable now. Investors spot lower acquisition costs and faster product-market fit in frontier tech markets, and that shifts portfolio strategies toward the Global South.

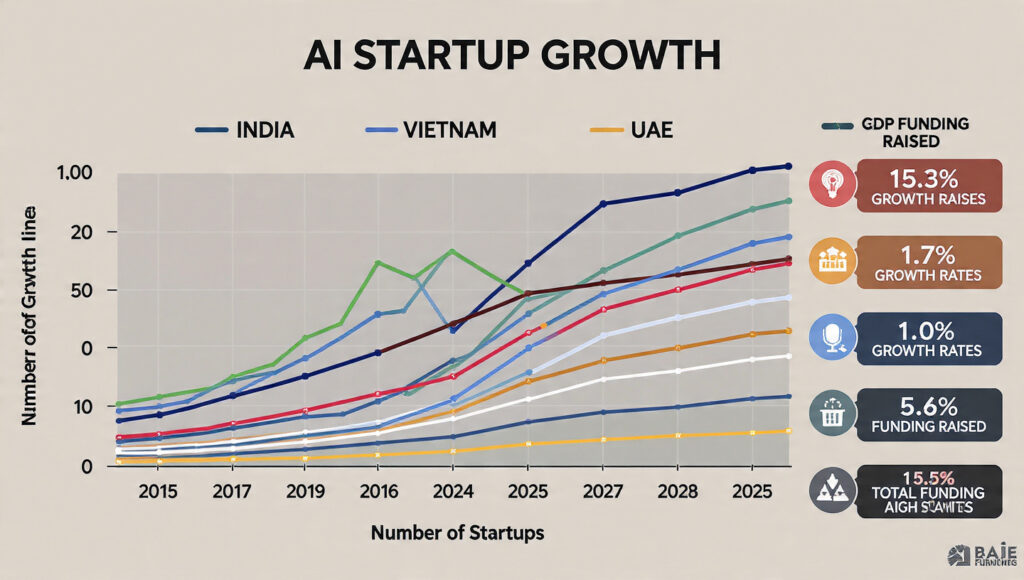

Let’s break it down, another driver is scale, not novelty. Large user bases supply training data and product feedback. The AI Investment Wave Hits the Global South: Innovation’s New Frontier is visible in VC allocation changes, and the FII study says 87 to 90 percent of investors plan to increase regional bets. FII Institute Site+1

1.1 From Silicon Valley to South Asia: The Great Investment Rebalance

Venture funds reweight portfolios to reduce unit economics and find more tolerant markets. AI investment shift happens as funds chase more efficient customer acquisition, and South Asia offers both volume and savings. This rebalance is pragmatic, not ideological.

What makes this move stick is system level support. Local cloud nodes, cheaper GPUs, and cross border product rollouts lower friction. The AI Investment Wave Hits the Global South: Innovation’s New Frontier encapsulates why investors pivot from cluster to corridor.

1.2 The Rise of Local Talent and Startups

Local founders solve local problems faster, and that draws capital. Strong developer communities and returnee entrepreneurs fuel Global South innovation, while incubators and angels fill early gaps. Startups now attract global VCs for market specific solutions.

This surge creates viable exit paths and talent retention. Where talent concentrates, R and D follows, and a virtuous cycle emerges. emerging-market AI becomes a real industry, not a hopeful fringe.

2. The Real Drivers Behind the AI Investment Shift

Investors want scale, lower costs, and policy clarity. Countries that fix regulation and increase compute access attract funds. The AI investment shift comes from practical economics, not hype, and that makes market entry more predictable.

Also, macro incentives play a role. Energy, telecom upgrades, and public procurement for AI pilots change the ROI picture. When governments fund trials, private capital moves faster. AI infrastructure in developing nations and public policy accelerate adoption. Tony Blair Institute+1

2.1 Affordable Data Infrastructure and Policy Pushes

Fiber and cloud access reduce launch costs and speed up training cycles. Lower latency and regional data centers cut operational expense. AI infrastructure in developing nations improves model performance and product reliability.

Policy nudges like sandbox regulations and research grants change investor calculus. Governments that enable procurement and talent visas attract long term capital. The AI Investment Wave Hits the Global South: Innovation’s New Frontier follows these signals.

2.2 Investors Chasing Untapped Markets and Better ROI

Here’s the thing, underserved consumers offer higher margins than saturated markets. Startups tailor AI for local payment, health, and logistics needs, and scale quickly. This is frontier tech markets logic, plain and simple.

Investors prefer earlier product market fit with fewer legacy costs. A focused local solution can expand regionally fast. So funds reallocate from crowded Western bets to emerging-market AI opportunities.

3. How the Global South Is Building Its Own AI Identity

What this really means is models trained on local languages behave differently. Teams tune data pipelines for noisy records and multilingual inputs. That creates distinct IP and improves adoption, and AI localization trends become central to success.

Local problems force new architectures and business models. Whether in agriculture or urban transport, solutions adapt to constraints, not copy Western forms. regional AI ecosystems will produce different tools and governance styles.

3.1 Language, Local Problems, and Smarter AI Models

Language matters, and models trained on local dialects reduce friction and bias. Local datasets produce measurable gains in accuracy and trust. That advantage is defensible, and it powers Global South innovation.

When teams embed context, they improve outcomes for users and regulators. The AI Investment Wave Hits the Global South: Innovation’s New Frontier therefore looks less like imitation, and more like recombination.

3.2 Collaboration Over Copying, A Different Innovation Mindset

Here’s the thing, cross border collaboration accelerates learning. Startups remix global tools, add local expertise, and scale regionally. That cooperative model differs from imitating Valley norms.

This approach fosters knowledge exchange, not one way transfer. AI talent migration and partnerships between universities and industry create a distributed knowledge base.

4. Case Studies: India, Southeast Asia, and the Middle East

India provides volume and developer depth, and that attracts R and D budgets. Indian startups use abundant transaction data for payments and fintech models. AI investment in India is growing fast, and policy shifts support local product makers. Recent reports show rapid startup formation and investor interest.

Southeast Asia moves quickly on mobile first solutions, and small markets scale across borders. The Middle East focuses on sovereign capability and public sector modernization. Both regions show how AI growth Middle East and Southeast Asia strategies differ, yet attract capital.

4.1 India’s Data Advantage

India combines scale, open datasets, and talent density. Massive user interactions produce training signals for diverse AI products. Local policy and private capital now align with market needs.

That makes India a natural base for AI investment shift, and investors treat it as both market and production center.

4.2 Southeast Asia’s Agile Ecosystem

Mobile first adoption means prototypes reach users fast. Startups iterate rapidly, and partnerships with telcos speed distribution. This agility reduces time to revenue.

Regional hubs like Indonesia and Vietnam show how AI startups in Southeast Asia can scale regionally without matching US valuations.

4.3 The Middle East’s Bet on AI Sovereignty

Gulf states back national AI strategies through sovereign funds and state programs. The goal is less dependency, and more local capability. That creates demand for enterprise AI vendors and research centers.

This strategy helps the Middle East attract long term projects, and it contributes to Global South innovation diversification.

5. The Next Frontier: Pakistan and South Asia’s AI Moment

Pakistan has underused talent and improving connectivity, and that offers opportunity. Universities churn out STEM graduates, and digital freelancers show product chops. South Asia technology boom could include Pakistan if investment flows properly.

What’s missing is consistent seed funding, research labs, and clear procurement paths. Local anchor customers and stronger innovation policy would change investor risk perception. AI investment shift could accelerate with those fixes.

5.1 Why Pakistan Could Ride the Wave

Diaspora links provide mentorship and capital, and niche vertical expertise can emerge fast. Entrepreneurs can build localized solutions for health, logistics, and finance. That multiplies emerging-market AI prospects.

With better R and D partnerships and founder support, Pakistan can move from service work to product led growth.

5.2 What’s Missing: Investment Confidence and R and D Depth

Investors need clearer regulation and stronger research outputs. Early exits and success stories build confidence, and that fuels scale rounds. Without that, growth stalls.

Policymakers and universities must co invest. That creates the conditions for sustained Global South innovation and investor interest.

6. What This Shift Means for Global Innovation

Decentralized innovation reduces systemic risk and increases contextual relevance. Multiple hubs produce diverse governance and product sets, and that matters for resilience. AI localization trends will shape how AI helps people.

Investors must add nuance to due diligence, and founders must build for local constraints. The AI Investment Wave Hits the Global South: Innovation’s New Frontier signals a wider, more resilient innovation landscape.

6.1 The End of a One-Size-Fits-All AI Economy

Local needs drive divergent model architectures and deployment practices. This produces better outcomes across contexts, and reduces bias from monolithic datasets. regional AI ecosystems will produce the next wave of practical tools.

Diversity in design helps global systems handle varied real world data, and that benefits users everywhere.

6.2 The Risk and Reward Equation for Investors

Early movers gain market share and local knowledge, and latecomers face higher costs. Regulatory changes, talent flows, and supply chains matter more than ever. AI investment shift requires granular risk models.

Investors who understand local rules and partners win, and those who ignore context lose.

7. The Future: A More Balanced Tech World

Expect regional hubs connected by capital and talent. No single center will dominate distant innovation, and that creates opportunities across continents. frontier tech markets will trade ideas and funding across borders.

Countries that blend policy clarity, research support, and early procurement will capture long term value. The AI Investment Wave Hits the Global South: Innovation’s New Frontier marks a structural change, not a fad.

7.1 A Global Network, Not a Global Hierarchy

Networks of hubs exchange IP, talent, and capital. Cooperation beats isolation, and knowledge diffusion accelerates problem solving. Global South innovation will keep proving its value.

That networked future means better local products, deeper research, and more equitable tech dispersal.

Case Study Table, Quick Facts

| Region | Strength | Investor Signal |

| India | Scale, developer depth, transaction data | High VC interest, local policy support. Stimson Center |

| Southeast Asia | Mobile first, fast iteration | Cross border scaling, telco partnerships. Middle East |

| Middle East | Sovereign funds, national strategies | Large public projects, research centers. |

| Pakistan | Talent supply, low costs | Needs seed funding and R and D partnerships |

Five Short QnAs for Voice Search and Snippets

Q1, Why investors are betting on the Global South?

A1, They seek scale, cheaper customer acquisition, and strong local demand. AI investment shift improves unit economics quickly.

Q2, How emerging markets are changing the AI playbook?

A2, They build models for local languages and constraints, and that increases adoption and value.

Q3, What makes the Global South different from Silicon Valley?

A3, It centers on practical problem solving, price sensitivity, and data diversity rather than feature racing.

Q4, How governments are fueling AI growth?

A4, Through sandboxes, procurement pilots, and funding for research, which lowers investor risk. AI policy and regulation matter.

Q5, What is the new frontier of AI talent and capital?

A5, Regional hubs that mix local talent with diaspora capital, producing market specific IP.

Leave a Reply